federal estate tax exemption 2022

As a result of the latest tax reform the standard deductions have increased significantly however many other deductions got discontinued as a result of the same tax reform. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019.

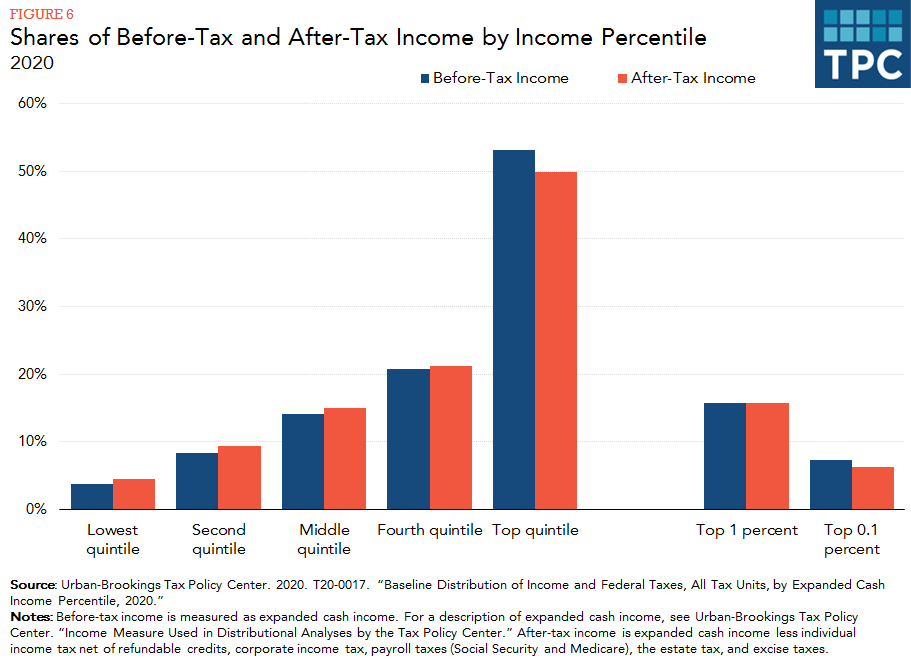

How Do Taxes Affect Income Inequality Tax Policy Center

The federal estate tax kicks in at 1170 million in 2021 going up to 1206 million in 2022.

. Legislation currently pending in Congress could change that limit if it becomes law. The Estate Tax is a tax on your right to transfer property at your death. The federal estate tax exemption for 2022 is 1206 million.

Federal Estate and Gift Tax lifetime exemption. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706PDF. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly.

Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. The 2017 Tax Cuts and Jobs Act temporarily doubled the estate tax exemption from 2018 through 2025 so it went from 549 million in 2017 to 1117 million in 2018 indexed for inflation.

This means that with the right legal steps a married couples estate exemption can be doubled when the second spouse dies. Employers Quarterly Federal Tax Return Form W-2. Or a 5000000 federal estate tax exemption with full step-up in tax cost.

Lets start with a simple overview of the federal estate tax and the federal estate tax exemption. The federal estate tax exemption provides that an estate with a value below the exemption amount can be passed on tax-free. 11700000 in 2021 and.

Federal Estate and Gift Tax Rates Exemptions and Exclusions 1916-2014 Year Estate Tax Exemption Lifetime Gift Tax Exemption Annual Gift Tax Exclusion Maximum Estate Tax Rate Maximum Gift Tax Rate Source. GiftEstate Tax Lifetime Exemption. IRS Standard Tax Deductions 2021 2022.

However a lifetime exemption commonly called the unified credit will be applied. A deceased person owes federal estate taxes on a taxable estate. There is a common misconception that you must pay gift taxes if you give away more than the annual exclusion to a single recipient.

The federal estate tax exemption is the amount excluded from estate tax when a person dies. Your first 1206 million passes tax. On the federal level the estate tax exemption is portable between spouses.

As of early 2022 the exemption amount is 1206 million per person. Note that under current law the increases in exemption amounts that began in 2018 are set to expire in 2026 at which point they will revert back to the pre-2018 numbers ie 5490000 per person indexed for inflation. Internal Revenue Service CCH Inc.

These standard deductions will be applied by tax year for your IRS and state returns respectively. 2022 1206 million. The tax starts at 18 on your first taxable 10000 and climbs to 40 on taxable assets over 1 million.

For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E. Below is a summary of the current federal estate gift and generation-skipping transfer tax provisions for 2022. The IRS recently released the new inflation adjusted 2022 tax brackets and rates.

The first 1206 million of your estate is therefore exempt from taxation. Employers engaged in a trade or business who pay compensation. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

The 2022 exemption is 1206 million up from 117 million in 2021. If all this reading is not for you. The deduction also applies in calculating the AMT.

For a couple in. Exemption amounts under the state estate taxes vary ranging from the federal estate tax exemption amount or 534 million indexed for inflation two states to 675000. When a taxpayer earns wages or sells an asset for a gain that individual is.

This estate tax exemption is portable which means that the. In 2010 the GST tax exemption was 5000000 but the GST tax rate was 0. For 2022 the federal estate tax limit increases to 1206 million for an individual and 2412 million for a couple.

Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A and the annual. In 2018 Marylands state estate tax exemption was set at 5 million and will remain at 5 million until changed by the General Assembly. For 2022 that amount is 1206 million.

The Tax Cuts and Jobs Act TCJA dramatically increased the unified federal gift and estate tax exemption from 549 million in 2017 to 1158 million for this year with inflation adjustments. Every taxpayer has a lifetime gift and estate tax exemption amount. If you do give someone more than the allowed annual amount that excess will be added to the value of your estate at the time of death to determine the amount subject to the combined Federal Estate and Gift Tax.

The federal estate tax is imposed on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States. Bobs estate wont have to use any of his estate tax exemption because all their assets are jointly titled and they pass directly to Sue by right of survivorship. The estate tax is a tax on your accumulated wealth assessed by the federal government when you die.

The estate tax rate is still 40 and Sues estate is still worth 18 million. Tax exempt refers to income earnings or transactions that are free from tax at the federal state or local level. In 2022 the lifetime exemption increased from 117 million to 1206 million.

For most corporate taxpayers the deduction generally will mean a federal income tax rate of 3185 on QPA income although certain oil- and gas-related QPA receive a less generous reduction that equates to a federal income tax rate of 329 for tax years beginning before January 1 2018. Assume that the federal estate tax exemption is still 1158 million at the time of Sues later death. Julie Garbers Annual Exclusion from Gift Taxes 1997-2010 and Federal Estate Gift and GST Tax Rates.

In Addition To The Federal Estate Tax With A Top Rate Of 40 Percent Some States Levy An Additional Estate Or Inheritan In 2022 Inheritance Tax Estate Tax Inheritance

Historical Estate Tax Exemption Amounts And Tax Rates 2022

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Fill Out I R S Form 1099 A To Discharge Debt In 2022 Form Templates Document Sharing

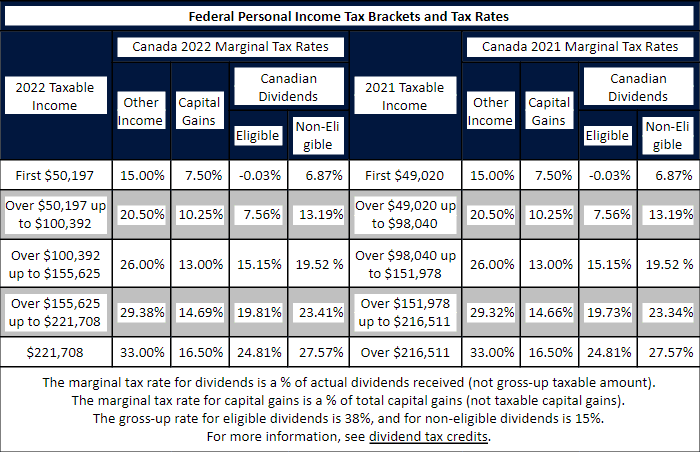

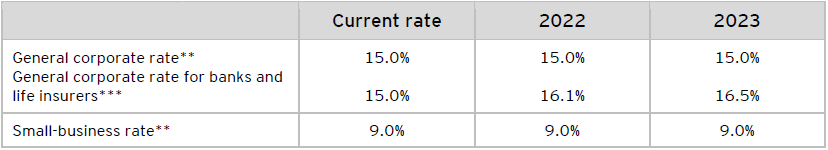

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Historical Estate Tax Exemption Amounts And Tax Rates 2022

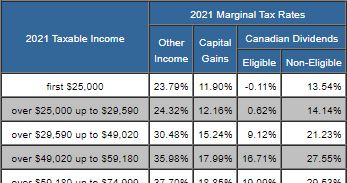

Tax Brackets Canada 2022 Filing Taxes

Did You Know That An Abc Trust A Form Of An Irrevocable Trust Can Be Helpful In States Where The Estate Tax Estate Tax Mirrored Sunglasses Men Tax Exemption

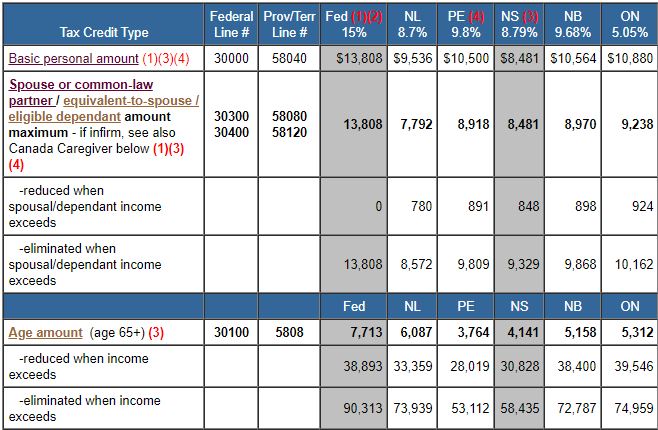

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Tuition Payment Federal Income Tax Tax

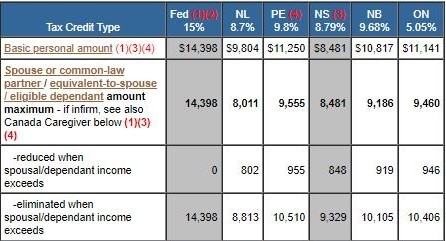

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

How Do Taxes Affect Income Inequality Tax Policy Center

U S Estate Tax For Canadians Manulife Investment Management

What Are Marriage Penalties And Bonuses Tax Policy Center

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Taxtips Ca Nova Scotia 2020 2021 Personal Income Tax Rates

What You Need To Know About The 11 Million Estate Tax Exemption Going Away